WHY INVEST IN EQUITY MUTUAL FUNDS?

WHY INVEST IN EQUITY MUTUAL FUNDS?The first thing that comes to mind when you think about investing is equities. As an asset class, equities have the potential to generate higher returns over the long term than most other types of assets (keeping in mind the principle of high risk, high reward) and hence play an important part in one’s investment portfolio.

There are two ways of investing in equity – you buy stocks on your own or you invest through equity mutual funds. Unless you are an expert, it doesn’t make sense to invest yourself. Equity mutual funds are a better choice to invest in equities given the wide choice of fund categories that one could explore.

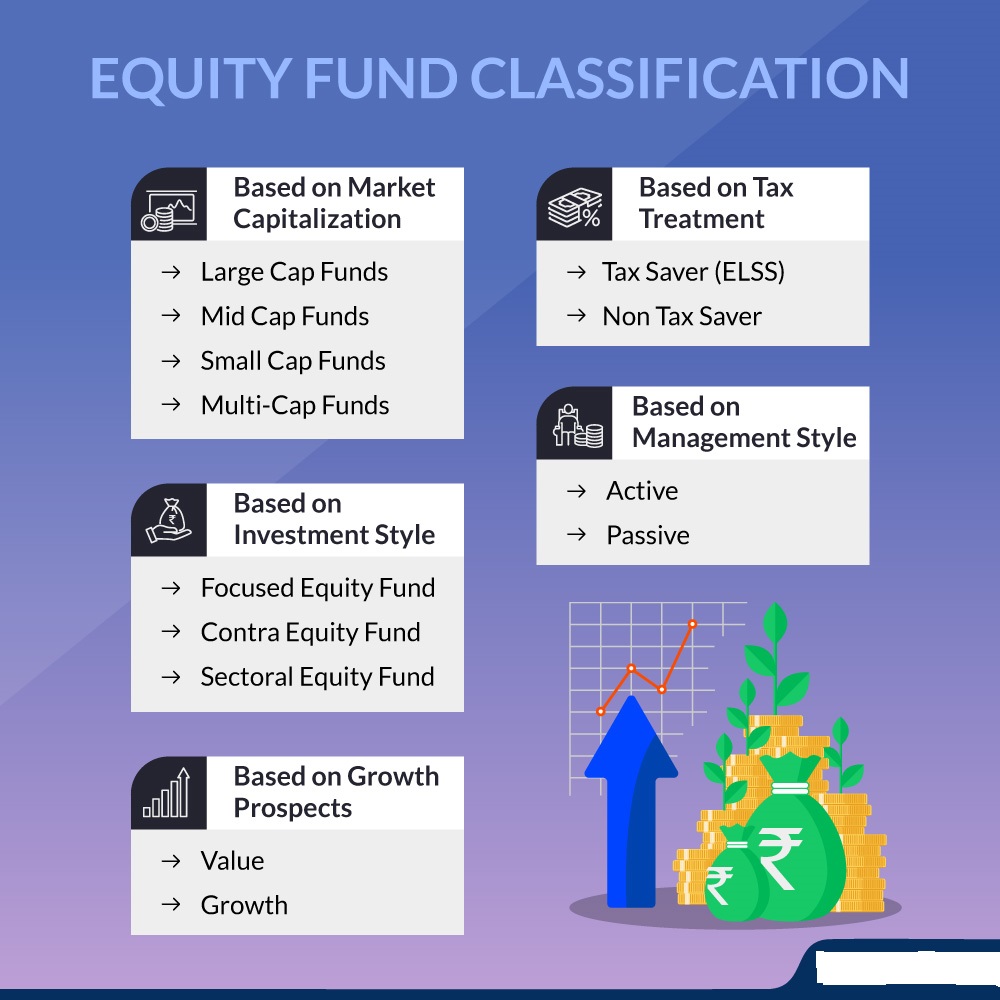

Equity funds can be principally categorized based on the size of listed companies (market capitalization) they invest in, the geography they focus their investments in and the investment style. Some equity funds invest in securities of a specific sector such as pharma, banking, automobile, IT, etc. are known as sectoral funds.

1. ELSS: Equity Linked Saving Scheme (ELSS) is again an open-ended equity fund with added tax benefits. ELSS invests at least 80% of its total assets in equities and equity related instruments. This fund comes with a statutory lock-in period of 3 years and is eligible for a tax deduction of up to Rs. 1.5 lakh under section 80C of the Income Tax Act, 1961.

2. Non-Tax Saving Equity Funds: All equity funds other than ELSS are basically non-tax saving equity funds. These funds are subject to Short Term Capital Gains Tax (STCG) or Long Term Capital Gains Tax (LTCG) based on the period of holding.