The process of buying life insurance is easy and simple. If you have been interested in buying an online life insurance policy, let us remind you that buying online is one of the simplest and quickest ways to insure, but you require to understand the policy terms and conditions. We at Fundzline not only let you buy the best plan that suits your need but also disclose the important features and hidden facts. Life insurance is a simple way to ensure that your loved ones receive the required financial security and protection in your absence. It helps you in creating a large pool of funds that can be used by your loved ones for a child’s future, marriage, purchasing a house, etc.

Life insurance is of significant importance if you wish to protect your family or dependents from any economic hardship in your absence.

It’s not an expense-many people think of it as one & choose to completely even consider its importance. It’s an very essential tool that will help you build wealth and at the same time offer complete protection to you and your family.

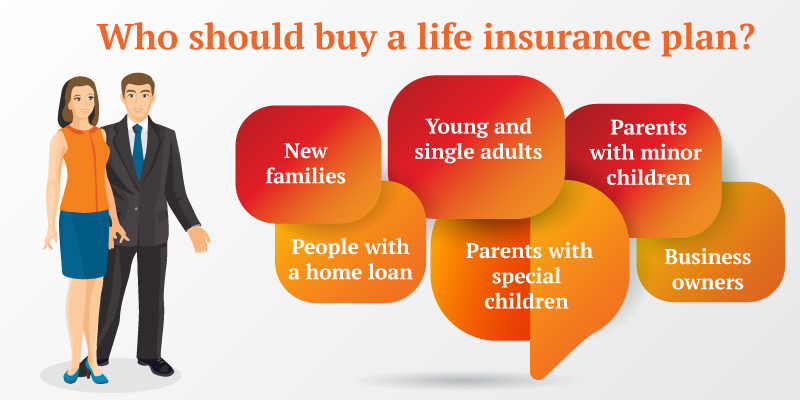

Single Individual: Even if you have no immediate dependents relying on you financially, it doesn’t mean that you don’t need a life insurance. There are many costs that you need to factor in and which needs additional income to fulfill them. Life insurance helps you meet such expenses while safeguarding your current income.

With Family: Unexpected passing of an individual leaves a lot of void and the surviving members are left to cope with a lot of stress and trauma. And no matter what, expenses never ceases to exist; it just piles on- be it rent, childcare expenses, loans, etc. In such scenario, loss of income would cause an immediate financial hardship and your loved ones are left struggling. Nobody wishes this upon their family, hence life insurance needs to be seriously considered.

Life insurance is required to ensure financial support in the event of your demise, to finance your childs education, to have a constant source of income after retirement and to meet other financial contingencies and life style requirements arising due to serious illness or accident. Everyone who has a family to support and is an income earner needs Life Insurance. The amount of Life Insurance coverage you need depends on many factors like: How many dependants do you have, What is your family lifestyle, What your investment needs are and how much you can afford.

Life insurance is required to ensure financial support in the event of your demise, to finance your childs education, to have a constant source of income after retirement and to meet other financial contingencies and life style requirements arising due to serious illness or accident. Everyone who has a family to support and is an income earner needs Life Insurance. The amount of Life Insurance coverage you need depends on many factors like: How many dependants do you have, What is your family lifestyle, What your investment needs are and how much you can afford.

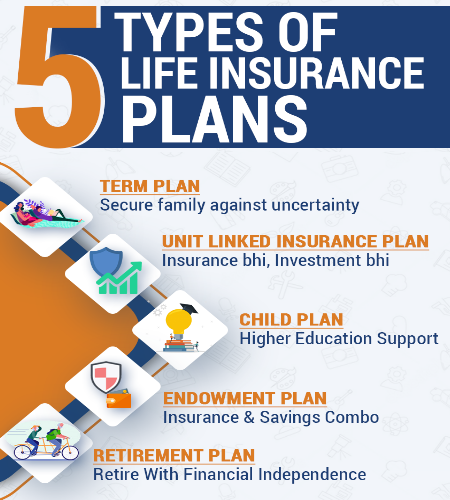

There are various types of life insurance policy

So from an investor’s point of view, an investment can play two roles – asset appreciation or asset protection. While most financial instruments have the underlying benefit of asset appreciation, life insurance is unique in that it gives the customer the reassurance of asset protection, along with a strong element of asset appreciation.

The core benefit of life insurance is that the financial interests of one’s family remain protected from circumstances such as loss of income due to critical illness or death of the policyholder. Simultaneously, insurance products also have a inbuilt wealth creation proposition. The customer therefore benefits on two counts and life insurance occupies a unique space in the landscape of investment options available to a customer.

If you are searching for a best insurance plan for yourself and your family. Among number of insurance plans to choose from numerous insurance companies functioning in India only one name strikes in mind, LIC. LIC is the most renowned, reliable and oldest insurance functioning company in India. LIC is a state owned government organization with 100% stakes or shares with Government of India. LIC plays a very important role in GDP of India with over 7% share in GDP. About 24% of Indian Government expenses is with LIC or Life Insurance Corporation of India. LIC is one of the biggest organizations in India in term of customers, assets and employees. LIC is served by over 1 million employees functioning all over India. It is more than Rs. 13 Trillion of assets. LIC is the first preference of any person who is willing to get insured as it has multiple options, various choices of policies suiting each and every group of society.

Please feel free to contact us. We will get back to you with 1-2 business days. Or just call us now