In today’s fast moving world our financial needs and priorities rapidly change with our lifestyle, so planning towards retirement should not take longer time as it is never far around the corner. If planned appropriately, you can retire with dignity that sounds great in itself and make your retirement period as glorious as your present employed career. A successful retirement planning will never hurt you hard on your financial status, but will ensure you with the same lifestyle till the time you live.

Initiation of savings today will not spoil your precious retirement days, but will provide you an assurance that you will earn a satisfying income and enjoy a comfortable lifestyle after your financial career comes to an end and will help you to fulfill your dreams. Whether you are younger or middle aged, you’ve got time on your side no matter start putting money into a retirement account. A little investment towards it, at a early age can easily grow into a significant sum as soon as retirement comes about.

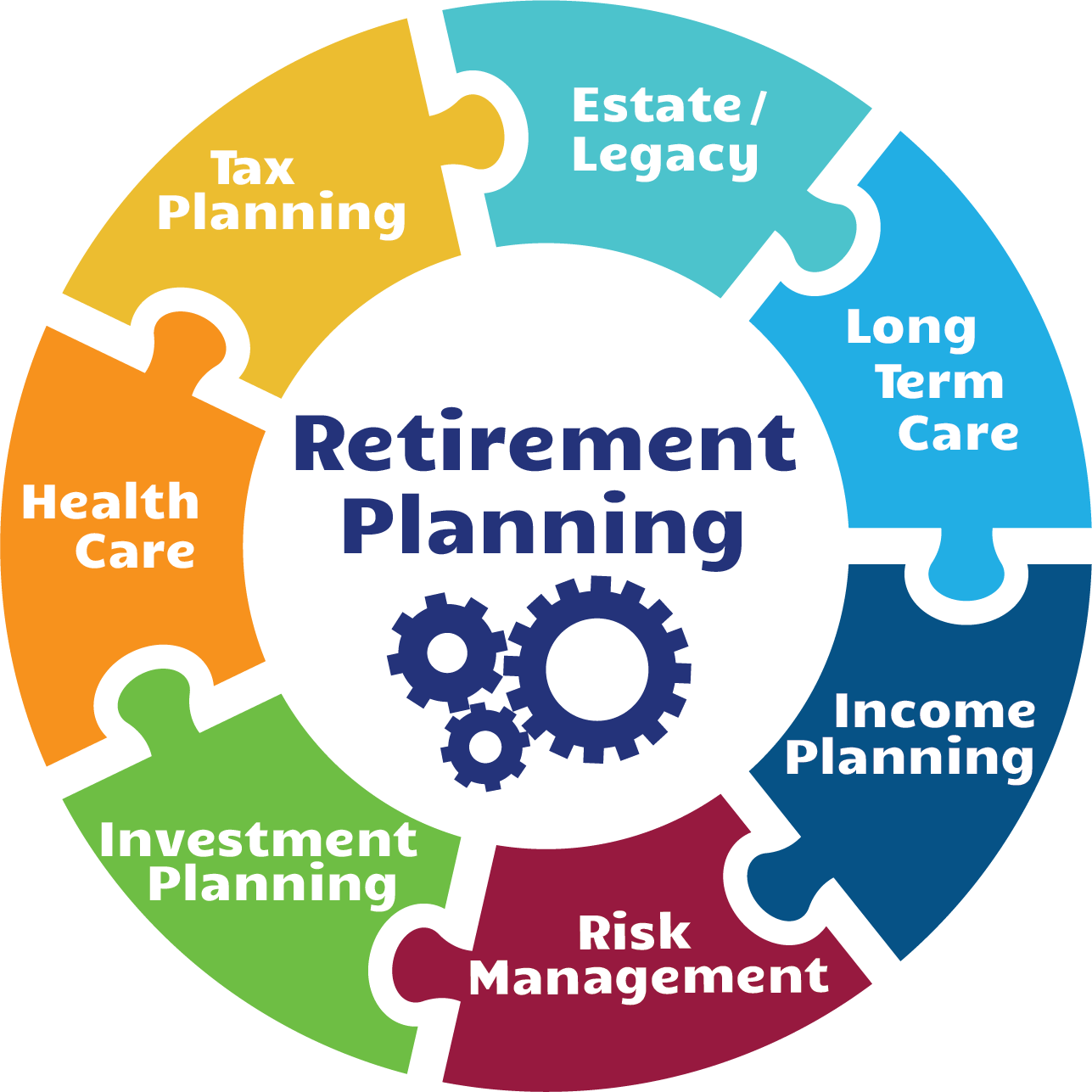

As soon as many of us reach the stage of retirement, the disability in our financial status becomes a major area of concern. During this period, the income generally stops but the expenses do not. We at Fundzline assess your present needs and future goals and then help you chart an appropriate and successful retirement planning for you. We offer many techniques in which it is possible to plan for your retirement solutions. The very first step in making retirement planning succesful usually involves plan of action that you can follow. We have proven asset allocation strategies that will get you higher “inflation-adjusted” returns on your assets. We also track and re-balance your assets to protect them from the volatility of the markets. Lots of people focus too much on the now or too much on the later and have a great deal of difficulty in relation to developing a happy medium for savings and investing.

Choose excellent retirement planning services from us and let your money grow for your precious retirement years. For more information or assistance, please contact us. We shall be happy to help you.

Fundzline is in the distribution domain for over 2 decades and has been helping people secure their financial tomorrow. The quality of your post retirement life depends on your ability to correctly estimate the retirement corpus needed at the time of your retirement. While computing the adequate amount of retirement corpus needed, it is always better to be conservative.

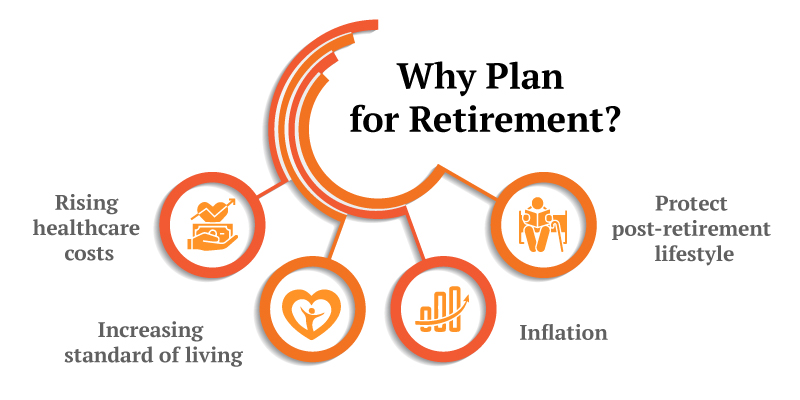

The following factors need to be considered while planning your retirement-

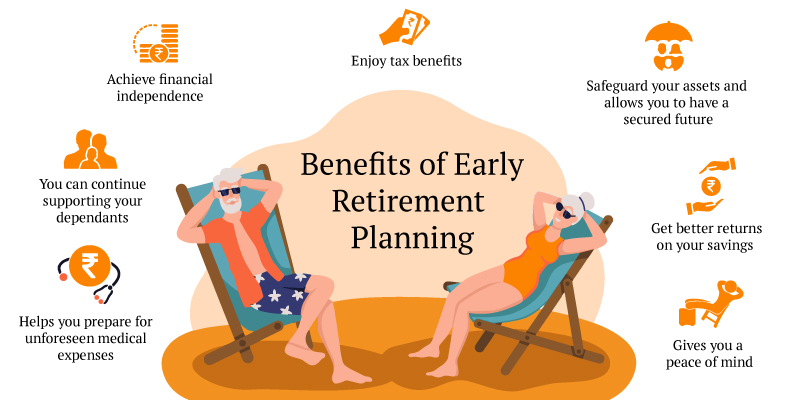

Still not convinced to start your retirement planning? Here are a few more reasons to start your retirement planning with Fundzline right away;

a) Customized retirement plan based on retirement goals

b) Trust the retirement planning services trusted by 900+ individuals

c) Constant support and assistance throughout your retirement planning process and beyond

d) Honest, transparent, and unbiased solution

If you have any questions, please do not hesitate to ask us. Please also call us or email us before visiting to make sure that you will be served with our best services.

+91-9811480408

services@fundzline.com