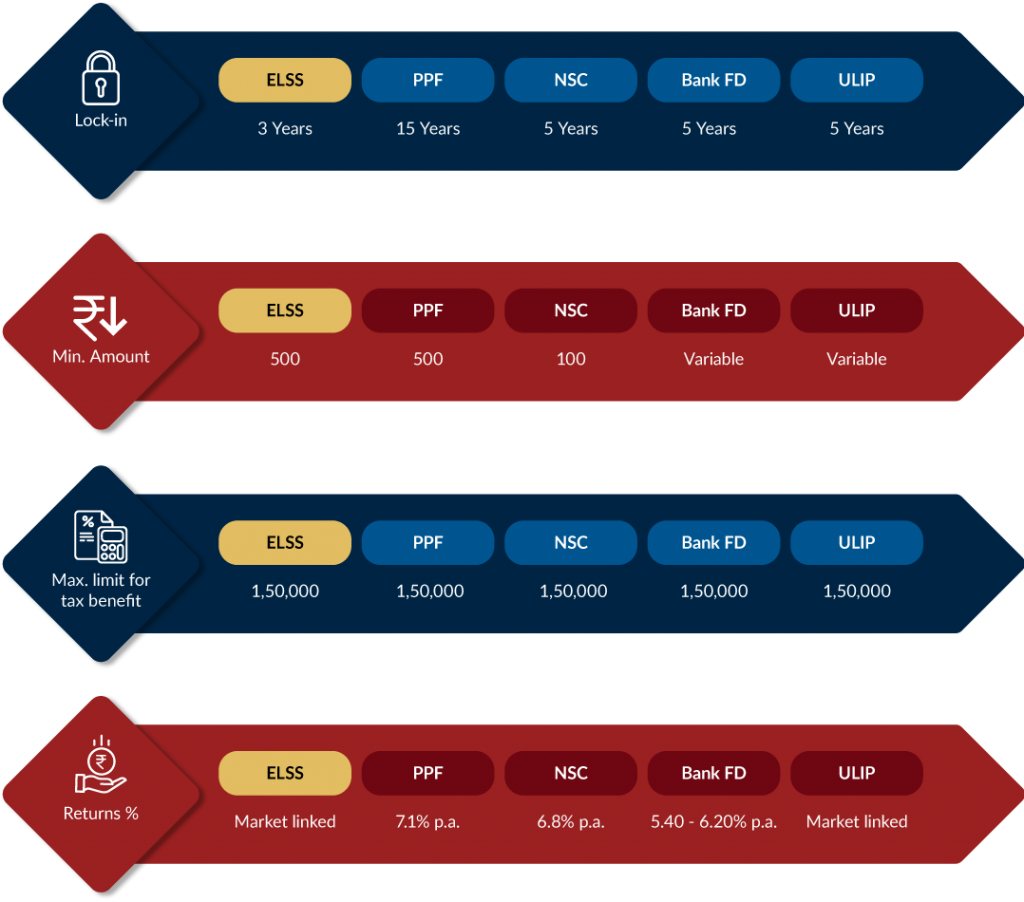

The choice to invest, is always subjective to the individual. Wealth generation, tax-saving and security are significant outcomes for any type of investment. This is why investments have increased over the past few years in India. One such type of investment that serves the purpose of wealth generation and tax saving option is ELSS mutual funds or equity-linked saving scheme. ELSS significantly fulfills the criteria of investment. Here’s a look at the advantages of ELSS Mutual Funds: Advantages of ELSS Mutual Funds: Lock-in period – With a lock-in period of 3 years, ELSS ensures you invest for that time frame minimum and then offers better liquidity options once that period has been surpassed.

The choice to invest, is always subjective to the individual. Wealth generation, tax-saving and security are significant outcomes for any type of investment. This is why investments have increased over the past few years in India. One such type of investment that serves the purpose of wealth generation and tax saving option is ELSS mutual funds or equity-linked saving scheme. ELSS significantly fulfills the criteria of investment. Here’s a look at the advantages of ELSS Mutual Funds: Advantages of ELSS Mutual Funds: Lock-in period – With a lock-in period of 3 years, ELSS ensures you invest for that time frame minimum and then offers better liquidity options once that period has been surpassed.

Potentially higher returns – ELSS mutual funds comes under equity funds. Considering equity funds generate higher wealth, subjective to market fluctuations, you are bound to get better results. Better post-tax returns – One of the key benefits of ELSS investments is tax-saving. ELSS compensates for tax saving upto Rs 1, 50,000 p.a. Long term capital gains from ELSS are also tax free upto Rs 1 Lac. Gains over Rs 1 lac are taxable at just 10%. Lower taxes with higher returns makes it best instrument to invest. Convenient Investment – Investment in best ELSS mutual funds can be done monthly or lump sum amount. With monthly SIP’s, ELSS becomes a convenient option to invest small amounts and also inculcates a discipline of monthly saving. ELSS funds is primarily a tax-saving mutual fund. The only difference between tax saving ELSS mutual funds and other mutual funds is the lock-in period. Unlike other mutual funds where the investor can withdraw units at any time. In tax saving ELSS mutual funds, the investment is locked in for 3 years which is another way is a good option for untouched investments.

| FUND NAME | CATEGORY | 1Y | 3Y | 5Y |

|---|---|---|---|---|

| Mirae Asset Tax Saver Fund-Regular Plan-Growth | Tax Savings | 83.48% | 17.10% | 21.36% |

| Canara Robeco Equity Taxsaver Fund – Regular Plan – Growth | Tax Savings | 71.38% | 17.49% | 17.15% |

| JM Tax Gain Fund – Growth option | Tax Savings | 67.65% | 13.33% | 16.93% |

| DSP Tax Saver Fund – Regular Plan – Growth | Tax Savings | 74.85% | 13.15% | 16.08% |

| Axis Long Term Equity Fund – Regular Plan – Growth | Tax Savings | 54.23% | 14.70% | 15.93% |

| Kotak Tax Saver-Scheme-Growth | Tax Savings | 68.62% | 13.35% | 15.38% |

| Tata India Tax Savings Fund-Growth-Regular Plan | Tax Savings | 64.62% | 10.96% | 14.83% |

| UTI – Long Term Equity Fund (Tax Saving) – Regular Plan – Growth Option | Tax Savings | 71.49% | 12.03% | 13.82% |

| ICICI Prudential Long Term Equity Fund (Tax Saving) – Growth | Tax Savings | 74.68% | 11.35% | 13.50% |

| BNP Paribas Long Term Equity Fund – Growth Option | Tax Savings | 55.14% | 12.32% | 12.87% |

*The order of funds do not suggest any recommendations. The investor may choose the funds as per their goals. Returns are subject to change.

*As per the present tax laws, eligible investors (individual/ HUF) are entitled to deduction from their gross total income, of the amount invested in equity linked saving scheme (ELSS) upto Rs. 1,50,000/- (along with other prescribed investments) under Section 80C of the Income Tax Act, 1961. Tax savings of Rs. 46,800/- shown above is calculated for the highest income tax slab. Long term capital gain and dividend distribution tax as applicable. Tax benefits are subject to the provisions of the Income Tax Act, 1961 and are subject to amendments, from time to time.