Mutual funds are ideal for investors who want to invest in various kinds of schemes with different investment objectives but do not have sufficient time and expertise to pick winning stocks. Mutual fund investments give you the advantage of professional management, lower transaction costs, and diversification, liquidity and tax benefits.

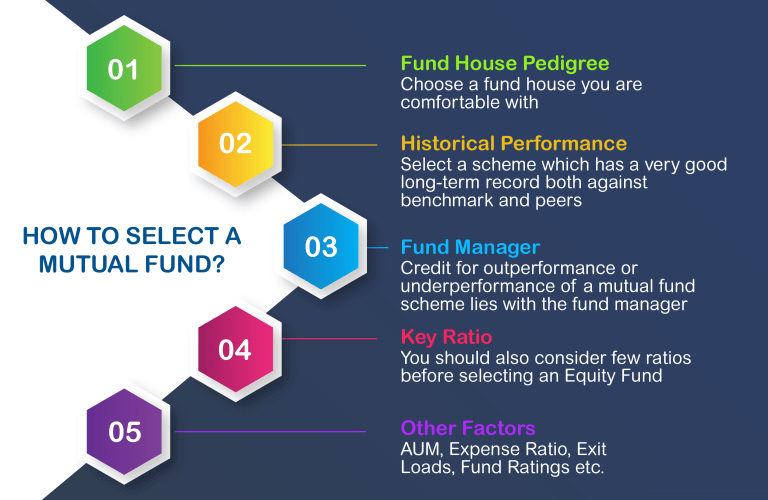

There are thousands of schemes to choose from. Once you have finalized the fund type, you should consider following factors to finalize which scheme suits you the most:

from. Once you have finalized the fund type, you should consider following factors to finalize which scheme suits you the most:

1. Fund House Pedigree : When you are going to invest in a mutual fund, you are trusting the fund house to manage your money. This is why the pedigree of the fund is important. Decisions taken by the fund house and the fund manager may have a direct impact on your investment’s performance and the realisation of your financial goals.

2. Historical Performance : The most important criterion for selection of the scheme. You should choose the scheme which has a very good long-term record both against benchmark and peers. We recommend you go for funds which have consistently outperformed their benchmark index and peers over medium-longer terms (3, 5 and 10 years).

3. Fund Manager : The credit for outperformance or underperformance of a mutual fund scheme lies with the Fund Manager (and his research team).

4. KeY Ratios : One should also consider few ratios before selecting an Equity Scheme:

5. Asset Under Management: Net assets of any scheme gives a fair idea of the confidence level of investors in the mutual fund scheme.

6. Expense Ratio: You should avoid schemes with very high Expense ratio. You should choose a scheme with average or below average expense ratio. Most of the established fund schemes will have lower expense ratio. Average Expense ratio of Equity funds (based on type) is between 1.8-2.2%

7. Exit load: There are few funds which charge very high Exit load as high as 3%. Though Equity fund investments are for long term but still you should avoid very high exit load funds as it kills your liquidity and ability to switch out in case of non-performance.

8. Fund Ratings: You can even refer the ratings provided by third party agencies such as Value Research, Morningstar, Crisil etc. But, don’t over depend on these ratings as they can be quite confusing as everyone has their own way of ranking mutual funds.

Mutual Funds are no doubt better than other investment options, mainly because of following reasons:

How a mutual fund performs depends much on the fund manager. Which stocks he chooses for investment, when to hold, when to buy and when to sell – are the important drivers for growth of any mutual fund. Further, if an investment has to be done in mutual fund schemes, make sure that the investment is at least for 3 years.

How a mutual fund performs depends much on the fund manager. Which stocks he chooses for investment, when to hold, when to buy and when to sell – are the important drivers for growth of any mutual fund. Further, if an investment has to be done in mutual fund schemes, make sure that the investment is at least for 3 years.

There are short term factors like market sentiments, elections, because of which indexes are not stable. Herein lies the opportunity to gain. Because of this very ‘volatile’ nature of market, mutual funds, especially equity mutual funds’ NAV tend to fluctuate. You can invest when the market is low and redeem when the market is high.

Trusting someone with your hard earned money is difficult indeed. Choosing a scheme out of 8000+ schemes is worse. When you are investing, the kind of scheme you are putting in your money matters the most. It is extremely important to know how much risk you are ready to withstand, which again depends upon multitude of factors. Also, with time, portfolio rebalancing is important. How much should be allocated to debt, and how much should be put in equity and with time making sure that the ratio is maintained, is a mountainous task.

Trusting someone with your hard earned money is difficult indeed. Choosing a scheme out of 8000+ schemes is worse. When you are investing, the kind of scheme you are putting in your money matters the most. It is extremely important to know how much risk you are ready to withstand, which again depends upon multitude of factors. Also, with time, portfolio rebalancing is important. How much should be allocated to debt, and how much should be put in equity and with time making sure that the ratio is maintained, is a mountainous task.

Convenience:

* Simplifies the investment process by handling paperwork, transactions, and record-keeping.

Diverse Options:

* Offers a wide range of mutual fund choices from various fund houses, enhancing portfolio diversification.

Market Insights:

* Provides regular updates and market analysis to help investors make informed decisions.

Engaging a mutual fund distributor streamlines the investment process, and offers access to a variety of funds, making it a valuable resource for both novice and seasoned investors.

Broadly, any mutual fund will either invest in equities, debt or a mix of both. Further, they can be open-ended or close-ended mutual fund schemes.

Broadly, any mutual fund will either invest in equities, debt or a mix of both. Further, they can be open-ended or close-ended mutual fund schemes.

> Open-ended funds

In an open-ended mutual fund, an investor can invest or enter and redeem or exit at any point of time. It does not have a fixed maturity period.

> Close-ended funds

Close-ended mutual funds have a fixed maturity date. An investor can only invest or enter in these type of schemes during the initial period known as the New Fund Offer or NFO period. His/her investment will automatically be redeemed on the maturity date. They are listed on stock exchange(s).

Let’s take a look at the various types of equity and debt mutual funds available in India:

1. Equity or growth schemes: These are one of the most popular mutual fund schemes. They allow investors to participate in stock markets. Though categorised as high risk, these schemes also have a high return potential in the long run. They are ideal for investors in their prime earning stage, looking to build a portfolio that gives them superior returns over the long-term. Normally an equity fund or diversified equity fund as it is commonly called invests over a range of sectors to distribute the risk.

Equity funds can be further divided into three categories:

> Sector-specific funds: These are mutual funds that invest in a specific sector. These can be sectors like infrastructure, banking, mining, etc. or specific segments like mid-cap, small-cap or large-cap segments. They are suitable for investors having a high risk appetite and have the potential to give high returns.

> Index funds: Index funds are ideal for investors who want to invest in equity mutual funds but at the same time don’t want to depend on the fund manager. An index mutual fund follows the same strategy as the index it is based on.

> Tax Saving funds: These funds offer tax benefits to investors. They invest in equities and are also called Equity Linked Saving Schemes (ELSS). These type of schemes have a 3 year lock-in period. The investments in the scheme are eligible for tax deduction u/s 80C of the Income-Tax Act, 1961.

2. Money market funds or liquid funds: These funds invest in short-term debt instruments, looking to give a reasonable return to investors over a short period of time. These funds are suitable for investors with a low risk appetite who are looking at parking their surplus funds over a short-term. These are an alternative to putting money in a savings bank account.

3. Debt Mutual funds: These funds invest a majority of the money in debt – fixed income i.e. fixed coupon bearing instruments like government securities, bonds, debentures, etc. They have a low-risk-low-return outlook and are ideal for investors with a low risk appetite looking at generating a steady income. However, they are subject to credit risk.

4. Balanced funds: As the name suggests, these are mutual fund schemes that divide their investments between equity and debt. The allocation may keep changing based on market risks. They are more suitable for investors who are looking at a combination of moderate returns with comparatively low risk.

5. Hybrid / Monthly Income Plans (MIP): These funds are similar to balanced funds but the proportion of equity assets is lesser compared to balanced funds. Hence, they are also called marginal equity funds. They are especially suitable for investors who are retired and want a regular income with comparatively low risk.

6. Gilt funds: These funds invest only in government securities. They are preferred by investors who are risk averse and want no credit risk associated with their investment. However, they are subject to high interest rate risk.