Learn about the basics of investments, understand the jargons, primary concepts and prepare yourself for a successful investment journey.

In finance, an investment is the purchase of an asset today with the hope that it will provide regular income or appreciate in value in the future. Every individual divides his/her income in two broad parts:

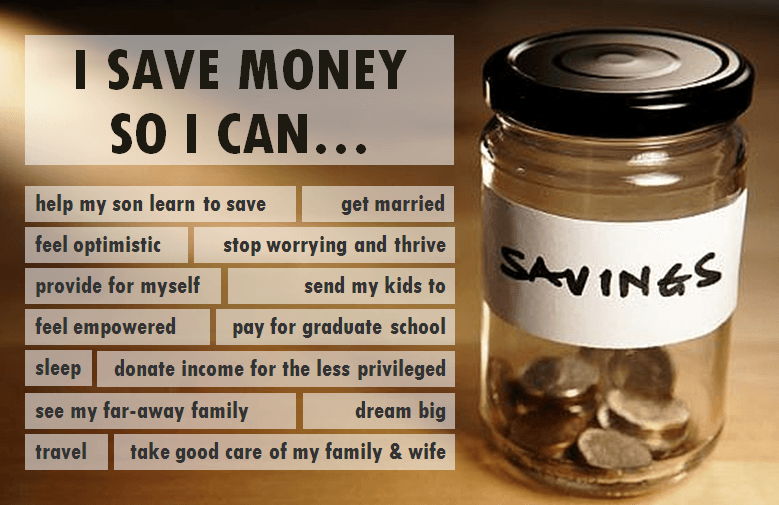

These saved funds usually lie idle either in a bank account or as cash at home. Also, many people who live from paycheck-to-paycheck find it difficult to save funds from their current incomes. Nevertheless, they want to be prepared for future expenses too! In both the scenarios, the desire to see the money grow over time and help manage costs later in life is deep rooted. This is where investment steps in.

People who either save or cut costs to ensure a better future, look to part with their funds temporarily by ‘investing’ them in options that offer returns on their investments.

Before you get into looking at the investment options available, it is important to assess and lay down your ‘Investment Objective’ This sounds rudimentary but avoiding this can lead to investing without focus and eventual financial loss!

Before you get into looking at the investment options available, it is important to assess and lay down your ‘Investment Objective’ This sounds rudimentary but avoiding this can lead to investing without focus and eventual financial loss!

The answer to these questions will help you determine an underlying theme behind all your future investments. We help you determine your investment objective. They are as below:

These are some commonly defined investment objectives. Every investor has a specific objective which needs to be identified. Once the investment objective is defined, then you start looking at investment options that match your financial goals. Some such options are: SAVINGS ACCOUNTS | BANK FIXED DEPOSITS | POST OFFICE SMALL SAVINGS SCHEMES | PUBLIC PROVIDENT FUND | DEBENTURES | BONDS | COMPANY DEPOSITS | MUTUAL FUNDS | LIFE INSURANCE POLICIES | EQUITY | REAL ESTATE | GOLD AND MANY MORE.

Investment is a journey and not a destination. Prepare well before you set foot on this journey and improve your chances of earning good returns.